March saw the clocks go forward, nights get lighter and the weather get warmer! On top of that, we’ve seen plenty going on in the world of food and drink. As we prepare for months of beer gardens and barbeques, we’ve seen lot’s going on across the sector with a big focus on TikTok trends, inflation and continuing success for the soft drinks category.

Finding Your Niche

TikTok is home to all of the weird and wonderful food and drink creations, and one thing most accounts have in common is they know their niche. Having a niche on TikTok seems to be key to an influencer’s success on the platform and this is especially true when it comes to food.

First, let’s start with butter. Chef, Thomas Straker, started a butter series on TikTok back in 2022 in which he mixed butter with all sorts of different ingredients – from Bloody Mary butter to Whiskey Butter and Chicken Skin Butter. The series, called ‘All things Butter’ was incredibly popular, so much so that he has repeated the series once more, titled ‘More things Butter’.

The hashtag #allthingsbutter currently has 68.4M views so it is no surprise that the series has gained so much attention. Following the success of the series, Thomas Starker has teased the launch of his very own butter brand on Instagram – called All things Butter. This transitions shows just how well attaching himself to niche content has elevated his personal brand and led to products launches of his own.

Similar success can be seen with TikTok creators such as Sandwich King (@itssandwichking), El Burrito Monster (@elburritomonster) and Wrap God (@wrapgodofficial) who all have a niche when it comes to TikTok content. Brands can tap into this success by partnering with similar creators who are known for certain food & beverage niches to showcase products in a different way to how they may traditionally be used.

Cookbooks & Pop Ups

Celebrity cookbooks have always been popular. However, now we are seeing a rise in the influencer cookbook potentially taking over. Currently, Nathan Anthony’s (Bored of Lunch) cookbooks are numbers one and two in the UK charts – with the Healthy Air Fryer Book taking the top spot and Healthy Slow Cooker Book taking the number two spot.

The interest in cookbooks presents an interesting opportunity for brands to continue to partner with influencers on developing specific recipes and even recipe books as the appetite is still there for these products.

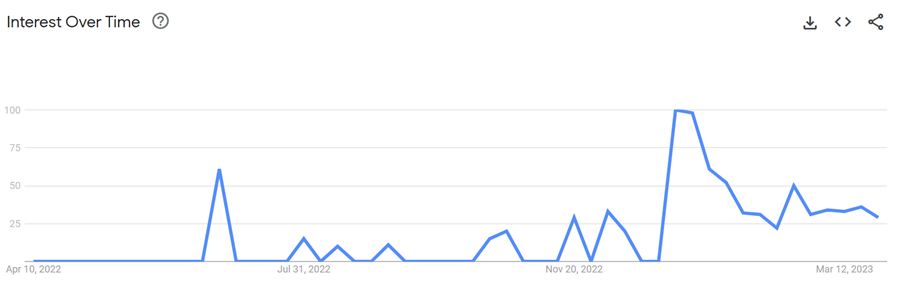

Searches for Bored of Lunch’s recipes have continued to spike into 2023 on Google, as the trends show below:

In addition to Google searches, TikTok still sees a high number of views on recipe content – with 13 million views in the last week alone.

Soft Drink Trends

We’ve discussed previously the surge in popularity for non-alcoholic alternatives such as alcohol-free beers and other beverages. However, there has also been an increase in the popularity of different soft drinks. Most notably, Trip, which has become the fastest growing soft drink brand in the UK after growing by 522% in the last year.

Trip, which is already the UK’s No.1 CBD brand has seen a big surge in popularity recently, especially in the eyes of Gen Z who seem to be driving the increase. According to research conducted, Gen Z consumers are more likely to try CBD drinks and switch to non-alcoholic alternatives.

Alongside the demand for CBD drinks, we are also seeing an increase in searches for Kombucha on Google Trends. In March, searches for Kombucha were up 80% – making it the 10th trending search in food & beverage last month.

The increase in demand for kombucha mirrors the demand for non-alcoholic drink alternatives, which also offer health benefits.

Inflation

The Guardian reported in March that UK inflation jumped on the back of food prices surging at their highest rate in 45 years which led to Bank of England increasing interest rates once again. In February, the consumer price index (CPI) rose to 10.4% compared to 10.1% in January, drive by a rise in the cost of drinks, meals out and fresh food. This was exacerbated by the ‘salad crisis’ in which items such as tomatoes, cucumbers and peppers were missing from supermarket shelves.

This CPI rise was unexpected, as analysts had originally predicted it would continue to fall in 2023, after hitting new heights in October 2022. The increase was driven by the rise in fresh food prices and shortage of salad products.

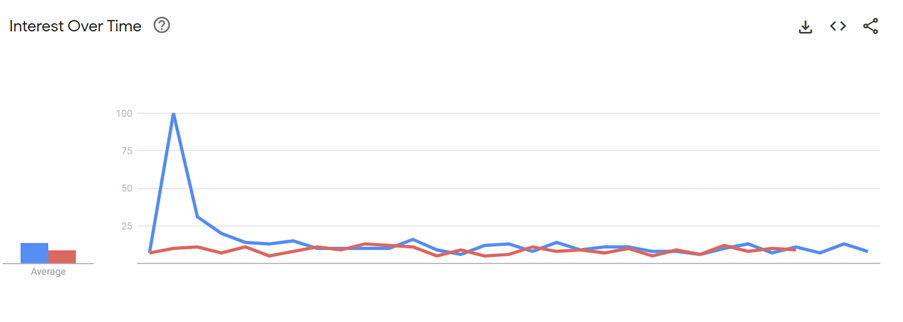

ONS data shows that food & non-alcoholic beverages specifically saw an inflation rate of 18.2% in February compared to the same time last year. The rise in prices is having a knock on effect when it comes to the food shop with half of adults buying less food when food shopping and over half are buying cheaper food because of the cost of living crisis.

It’s not only in the supermarkets where we’re seeing the cost of living having an impact on food and beverage choices, but also in the world of trade. The UK Food & Drink Show returns to the NEC, Birmingham, in April and will feature the latest products and key insights from the biggest brands in manufacturing, hospitality and food and beverage sector.

This year’s show will have a big focus on the cost of living crisis and how this is impacting the sector as well as products and solutions brands have to offer.

To find out more about how your brand can hop on the latest trends, drop us a note at hello@hatch.group